The Role of AI in Crypto Trading Bots

By John Krehbiel

June 26, 2024

Artificial intelligence will transform the financial markets, providing unprecedented opportunities for enhanced trading performance and risk management.

Artificial Intelligence (AI) has emerged as a crucial tool in today's fast-paced financial markets, particularly crypto trading. AI is not just a fad; it's a powerful technology that can significantly enhance trading strategies, making them more efficient and profitable. Understanding how AI can be leveraged in crypto trading can provide a significant edge for crypto enthusiasts, beginner traders, and day traders. At SYGNAL, we harness the power of AI to deliver advanced trading bots like our AltcoinWave AI and Fusion AI, which give us a unique edge in the markets.

Overview of AI in Crypto Trading

AI in trading involves using sophisticated algorithms and machine learning models to analyze vast amounts of data, identify patterns, and make informed trading decisions [2]. In crypto trading, AI can be used for various purposes, including algorithmic trading, sentiment analysis, market prediction, portfolio management, and fraud detection. Let's delve into how these applications work and their benefits.

Applications of AI in Crypto Trading

Algorithmic Trading

AI-powered algorithms execute trades at high speeds, refining criteria based on historical data to improve strategies and predict future price movements [3].

Sentiment Analysis

AI uses Natural Language Processing (NLP) to analyze social media posts, news articles, and other textual data to gauge market sentiment and inform trading decisions[4][5].

Market Prediction

Predictive analytics driven by AI provides insights into future market movements, using neural networks and time series analysis to aid strategy planning [6].

Portfolio Management

AI optimizes cryptocurrency portfolios by assessing the risk and return of various assets, recommending adjustments based on market conditions and individual risk tolerance.

Fraud Detection and Security

AI enhances security by detecting fraudulent activities, using machine learning algorithms to monitor trading activities in real-time and identify unusual patterns.

Benefits of Using AI in Crypto Trading

- Speed and Efficiency: AI can process and analyze data much faster than humans, allowing for quick decision-making and execution of trades.

- Accuracy and Precision: AI algorithms can make more accurate predictions based on data analysis, leading to more successful trades.

- 24/7 Trading: Unlike human traders, AI can operate around the clock, taking advantage of opportunities in the volatile cryptocurrency market at any time.

- Risk Management: AI can help manage and mitigate risks by continuously monitoring the market and adjusting trading strategies accordingly.

- Emotionless Trading: AI removes the emotional component from trading, often leading to better decision-making.

Disclaimer: Even AI Has Its Limitations

Trade Wisely, Embrace the Future!

- Risk Awareness: Trading cryptocurrencies involves significant risk and can result in substantial losses.

- No Guarantees: While AI-driven trading strategies can enhance performance, they do not guarantee profits.

- Model Limitations: AI models are based on historical data and predictive algorithms that may not always accurately forecast future market conditions.

- Trade with Caution: Users should trade cautiously and consider their financial situation and risk tolerance.

- Seek Professional Advice: It is advisable to conduct thorough research and seek professional advice before making any trading decisions.

Despite the risks, the potential for growth and innovation in crypto trading with AI is immense. Embrace the future with informed confidence!

Challenges and Considerations

While AI offers significant advantages in crypto trading, there are also important challenges and considerations to keep in mind. Here is a comparison of the pros and cons of using AI in trading:

| Pros | Cons |

|---|---|

|

Speed and Efficiency AI can process and analyze data much faster than humans, allowing for quick decision-making and execution of trades. |

Data Quality and Availability AI models rely heavily on high-quality data. In the crypto market, data can be sparse, noisy, or unreliable, affecting the accuracy of AI predictions. |

|

Accuracy and Precision AI algorithms can make more accurate predictions based on data analysis, leading to more successful trades. |

Market Volatility The crypto market is highly volatile and unpredictable, challenging even the most sophisticated AI models. |

|

24/7 Trading Unlike human traders, AI can operate around the clock, taking advantage of opportunities in the volatile cryptocurrency market at any time. |

Regulatory Issues The regulatory environment for cryptocurrencies is still evolving, and compliance with different regulations across jurisdictions can be complex. |

|

Risk Management AI can help manage and mitigate risks by continuously monitoring the market and adjusting trading strategies accordingly. |

Technical Complexity Implementing AI systems requires significant technical expertise and resources, which can be a barrier for smaller trading firms. |

|

Emotionless Trading AI removes the emotional component from trading, often leading to better decision-making. |

Overfitting AI models may become too closely fitted to historical data, making them less effective in predicting future market movements. |

|

Enhanced Security AI enhances security by detecting fraudulent activities, using machine learning algorithms to monitor trading activities in real-time and identify unusual patterns. |

Cybersecurity Risks AI systems can be targets for hacking and other cyber threats, potentially compromising trading strategies and sensitive data. |

|

Innovation and Growth Potential The potential for growth and innovation in crypto trading with AI is immense, offering new strategies and improved performance. |

Ethical Concerns AI in trading raises ethical questions, such as market manipulation and fairness, which must be addressed to maintain market integrity. |

Strategic and Business Implications

Understanding the strategic and business implications of AI in trading is crucial for firms looking to stay ahead in the competitive market. Below is a comparison of AI-driven trading strategies versus traditional trading strategies.

AI-Driven Trading Strategies

-

Data Analysis

Utilizes advanced algorithms and machine learning to analyze vast amounts of data and identify patterns.

-

Execution Speed

Executes trades in milliseconds, capitalizing on market opportunities quickly.

-

Risk Management

Continuously monitors the market and adjusts strategies to mitigate risks.

-

Emotionless Trading

Removes emotional bias from trading decisions, leading to more rational outcomes.

-

24/7 Operation

Operates around the clock, taking advantage of global market opportunities.

Traditional Trading Strategies

-

Data Analysis

Relies on manual analysis and experience, which can be time-consuming and prone to errors.

-

Execution Speed

Trades are executed at a slower pace, potentially missing quick market opportunities.

-

Risk Management

Depends on predefined strategies and manual adjustments, which may not respond swiftly to market changes.

-

Emotional Trading

Decisions can be influenced by emotions, leading to potentially irrational outcomes.

-

Limited Operation

Trading is often limited to market hours and human availability.

Key Strategic Point 1: Firms that effectively integrate AI into their trading strategies can gain a significant competitive edge, achieving higher returns and better risk management.

Key Strategic Point 2: AI-driven trading can lead to cost reductions by automating many trading processes, reducing the need for manual intervention.

Key Strategic Point 3: Offering AI-driven trading tools and insights can enhance customer experience and engagement, attracting more clients to a platform or strategy.

Technical Implications

Implementing AI in crypto trading involves several critical technical steps to ensure the system's efficiency, scalability, and security. It begins with establishing a robust data infrastructure capable of handling vast amounts of real-time and historical data. The development phase requires selecting appropriate algorithms, tuning hyperparameters, and continuously updating models to adapt to new data and market conditions.

Scalability is another crucial aspect, as AI systems must be able to manage increasing data volumes and higher trading frequencies as the business grows. Seamless integration with existing trading platforms is essential to maintain smooth operations. Finally, advanced cybersecurity measures must be implemented to protect AI systems from potential threats, ensuring the integrity of trading strategies and data.

Key Phases in AI Model Development

-

Data Collection

Gathering high-quality, relevant data.

-

Data Preprocessing

Cleaning and organizing data.

-

Model Development

Designing and developing models.

-

Model Training

Training models on historical data.

-

Model Evaluation

Assessing model performance.

-

Deployment

Integrating models into the platform.

-

Monitoring

Ongoing performance monitoring.

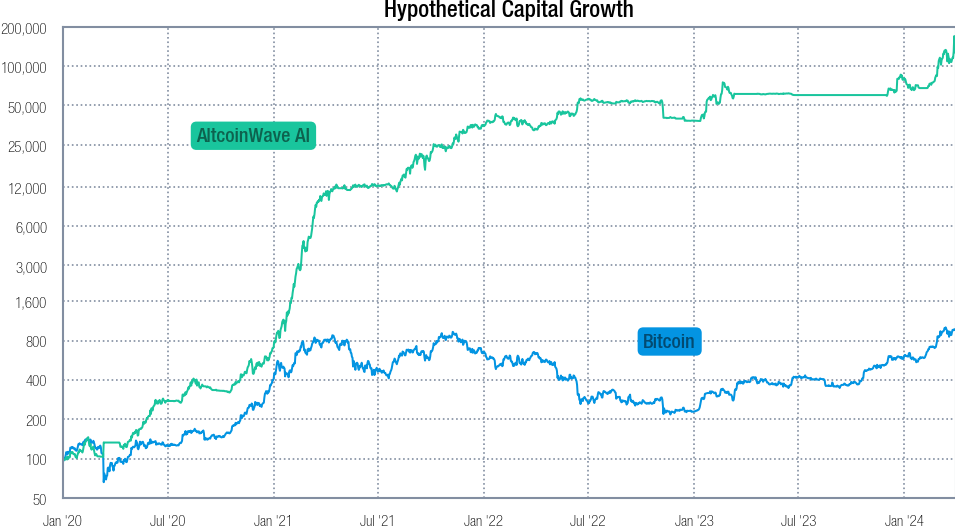

Case Studies: AltcoinWave AI Strategy and Fusion AI Strategy

AltcoinWave AI Strategy

The AltcoinWave AI strategy demonstrates the effective use of AI in optimizing investments in the cryptocurrency market. This strategy leverages AI technologies to navigate the highly volatile altcoin market, aiming to maximize returns during bull markets and minimize losses during bear markets. It has a proven track record of delivering consistent returns, outperforming the market in both bullish and bearish conditions.

Market Sentiment Analysis

The AltcoinWave AI continuously collects market-related articles, focusing on high-quality information while filtering out noise. Using Natural Language Processing (NLP) algorithms, the AI assesses the sentiment of this data to gauge market sentiment towards specific assets. By breaking down articles into meaningful pieces and determining the overall sentiment, the AI can make informed decisions on when to trade.

Quantitative Timing and Risk Management

The AI identifies market phases by analyzing historical price data and sentiment trends. This allows it to invest primarily during bull markets and avoid or minimize exposure during bear markets. Additionally, dynamic stop-loss orders are implemented to manage risk per trade, cutting potential losses early to protect capital.

Momentum-Based Coin Selection

Using more traditional metrics, the system selects the top-performing altcoins based on momentum indicators, identifying coins likely to continue their upward trajectory. Periodic portfolio rebalancing ensures the strategy adapts to changing market conditions and maintains optimal asset allocation.

Robustness Testing and Model Validation

To ensure reliability, the team behind AltcoinWave AI evaluates its models using randomized subsets of data and conducts extensive backtesting and forward testing. This process helps validate the models' predictive power and reliability, including metrics such as capital growth, expectancy, and drawdown across multiple exchanges and coin sets.

By leveraging these AI-driven components, the AltcoinWave AI strategy achieves significant returns compared to traditional benchmarks, providing lower drawdowns and higher Sharpe and Sortino ratios.

Learn More

Learn More

Hypothetical Backtests: January 1, 2020 to March 31, 2024. Hypothetical values net of fees, assuming an initial investment of 100 USDT and 1% fees and slippage, and signals are implemented as trades one day after the signals are issued. Fees and slippage rates used in calculating these hypothetical values may vary depending on the platforms or exchanges where this strategy is executed, potentially impacting the overall performance outcomes.

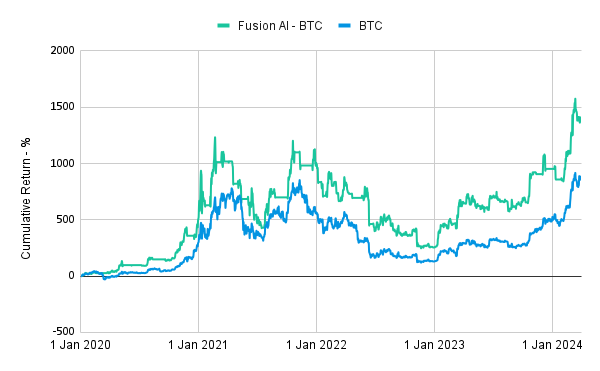

Fusion AI Strategy

Fusion AI is another prime example of how AI can optimize trading in the cryptocurrency market. It mainly focuses on Bitcoin (BTC) and Ethereum (ETH). This strategy combines traditional trading methodologies with advanced AI technologies to provide a robust and adaptive trading system.

Hybrid Trading Approach

Fusion AI merges classical trading methods with modern AI analysis. It uses traditional quantitative techniques such as price-data analysis, technical indicators, and AI-driven sentiment analysis. This synergy ensures a comprehensive understanding of the market from multiple dimensions.

Daily Signal Generation

The system generates daily trading signals for BTC and ETH, offering actionable insights based on comprehensive market data and AI analysis. These signals help traders navigate market volatility and optimize their returns by providing precise entry and exit points.

Sentiment and Quantitative Analysis

While not overly reliant on large language models, Fusion AI incorporates sentiment analysis to gauge market sentiment from various sources, helping understand broader market trends and investor behavior. Traditional quantitative methods reinforce AI predictions, ensuring robustness and reliability in its trading signals.

Risk Management

Fusion AI maintains a medium risk profile and uses AI-enhanced tools for risk assessment and management. This includes monitoring market conditions and adjusting positions to mitigate potential losses, ensuring the strategy remains stable even in volatile market conditions.

Learn More

Learn More

Hypothetical Backtests: January 1, 2020, through April 1, 2024. Hypothetical cumulative returns net of fees, assuming 3 bps in fees and slippage per trade. Fees and slippage rates used in calculating these hypothetical values may vary depending on the platforms or exchanges where this strategy is executed, potentially impacting the overall performance outcomes.

Conclusion

Incorporating AI into crypto trading strategies offers many benefits, from speed and efficiency to enhanced risk management and emotionless trading. The AltcoinWave AI and Fusion AI strategies exemplify how advanced AI technologies can be effectively utilized to navigate the complexities of the cryptocurrency market, providing traders with significant returns and robust risk mitigation.

At SYGNAL, we leverage cutting-edge AI to empower our users with sophisticated trading tools that can adapt to the ever-evolving market conditions. Our AI-driven solutions are designed to help you stay ahead of the curve, whether you are a beginner exploring the crypto market or a seasoned trader looking to optimize your strategies.

Take the next step in your trading journey with SYGNAL. Explore our AI-powered trading bots today and experience the future of crypto trading.

Additional Reading and References

- Kurzweil, Ray. "How to Create a Mind: The Secret of Human Thought Revealed." Viking Adult, 2012.

- The Future of Forex Trading: Harnessing the Power of AI – aiforex.trading. https://aiforex.trading/?p=5

- The Role of AI in the Evolution of Decentralized Finance (DeFi) • MEXC Blog. https://blog.mexc.com/the-role-of-ai-in-the-evolution-of-decentralized-finance-defi-creator-babs/

- Leveraging Learning Language Models (LLMs) in Business Strategies | Shorts for Success. https://www.shortsforsuccess.com/techitems/leveraging-llms-in-business-strategies

- Social Listening Analytics - Audience Insights - Inginit. https://www.inginit.com/social-listening-analytics

- Best Artificial Intelligence Projects for Final Year. https://aiforsocialgood.ca/blog/artificial-intelligence-projects-for-final-year-a-comprehensive-guide-to-building-advanced-ai-systems