Crypto Trading Bots vs. Manual Trading: Which is Better?

By SYGNAL

July 24, 2024

In the dynamic world of cryptocurrency trading, choosing between the hands-on control of manual trading and the efficiency of automated trading can be challenging. This article delves into both strategies, examining their strengths and weaknesses to help you determine which method aligns best with your trading goals.

Understanding Manual Trading

Definition and Basics

Manual trading, which has evolved significantly with the advent of online trading platforms and brokerage services, involves making buy-and-sell decisions based on one's own analysis of market conditions. Traders execute these trades themselves using these technological tools. This method requires constant monitoring of the markets and a deep understanding of various trading strategies, technical indicators, and market sentiment.

Advantages of Manual Trading

Flexibility and Control: Manual traders are empowered to adapt their strategies in real-time, responding to market news and events as they unfold. This capability allows them to make nuanced decisions based on current conditions (1).

Ability to React to Real-Time News and Events: Manual traders can swiftly adjust their positions in response to breaking news or unexpected market developments, a thrilling aspect of manual trading crucial for capitalising on short-term opportunities or mitigating losses (2).

Leveraging Human Intuition and Judgment: Experienced traders can use their intuition and judgment, honed over years of market observation, to make decisions beyond what algorithms can predict. This human element can sometimes capture subtle market shifts that bots might miss (3).

Disadvantages of Manual Trading

Emotional Decision-Making: One of the significant drawbacks of manual trading is the impact of emotions on trading decisions. Understanding and managing these emotions, such as fear, greed, and other emotional factors, is crucial to avoiding impulsive trades that deviate from a planned strategy, often resulting in losses (4).

Requires Constant Monitoring and Significant Time Investment: Manual trading demands a substantial time commitment, as traders need to continuously monitor the markets and their positions. This can be exhausting and impractical for those unable to dedicate full-time attention to trading (1).

Risk of Human Error: Manual trading is susceptible to human error, such as mistiming trades, misinterpreting data, or making typographical mistakes when entering orders. These errors can lead to significant financial losses (4)

Exploring Automated Trading

Definition and Basics

Automated trading involves using software programs, known as trading bots, to execute trades on behalf of the trader. These bots operate based on predefined algorithms and trading strategies, making buy-and-sell decisions without human intervention. Automated trading systems can analyse market data, execute trades at optimal times, and manage multiple trading parameters simultaneously (5).

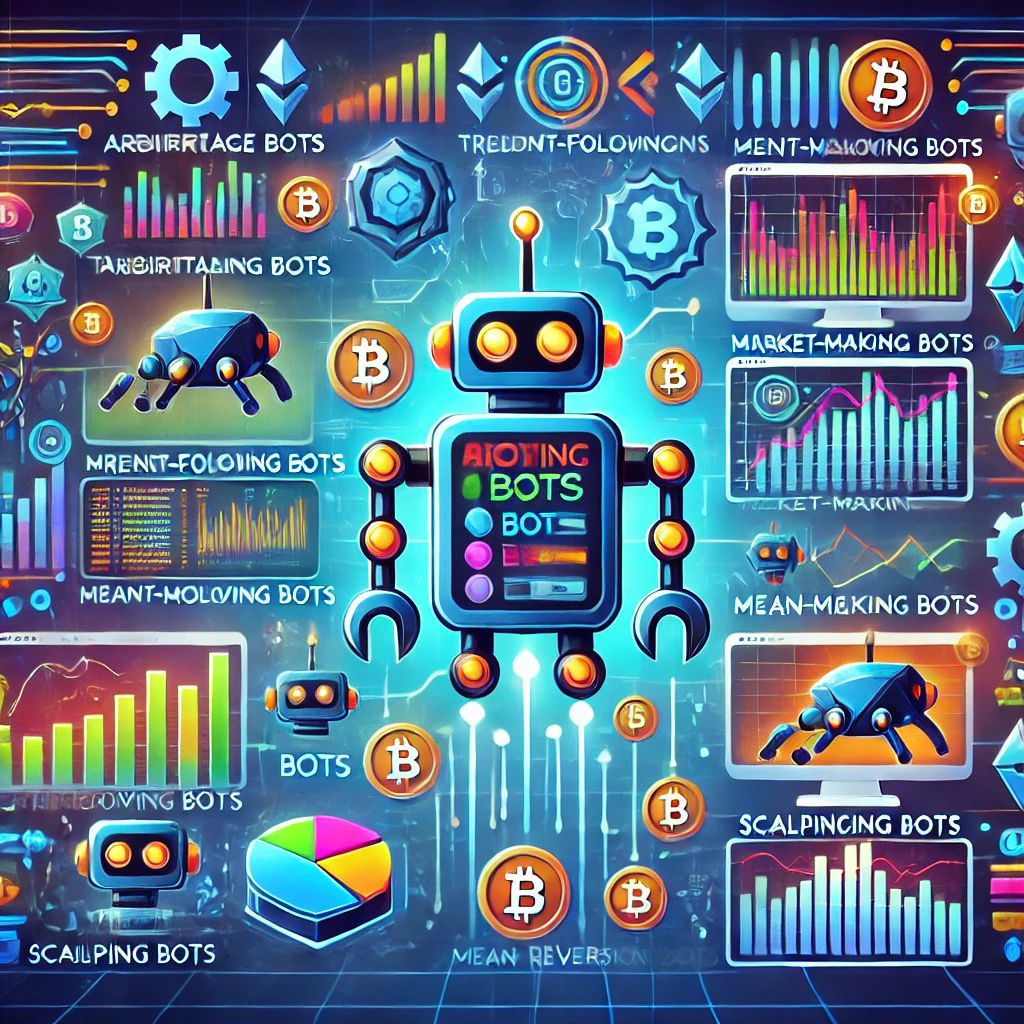

Types of Automated Trading Bots

Arbitrage Bots: These bots exploit price differences of the same cryptocurrency across different exchanges, buying low on one exchange and selling high on another. This strategy requires high speed and precision to be effective (6).

Trend-Following Bots: These bots identify and trade in the direction of prevailing market trends using technical indicators like moving averages and MACD (7).

Market-Making Bots: These bots provide liquidity by placing buy and sell orders around the current market price, profiting from the bid-ask spread (8).

Mean Reversion Bots: These bots assume that the price of a cryptocurrency will revert to its historical average over time, buying when the price is low and selling when it is high relative to the average (9).

Scalping Bots: These bots aim to profit from small price changes by making many trades quickly, relying on high-frequency trading to achieve gains (10).

Advantages of Automated Trading

24/7 Trading: Automated trading bots can operate continuously, taking advantage of market opportunities that human traders might miss due to time constraints or fatigue. This allows for consistent execution of strategies without interruption (11).

Eliminates Emotional Decision-Making: Bots trade based on predefined rules, removing the emotional aspect that often leads to poor decision-making during volatile markets. This ensures a disciplined approach to trading (12).

Efficient Execution of Complex Strategies: Bots can execute complex trading strategies with precision and speed, handling multiple assets and market conditions simultaneously. This can lead to more efficient and effective trading outcomes (13).

Disadvantages of Automated Trading

Requires Technical Knowledge for Setup: Setting up and configuring trading bots requires specific technical expertise. Traders must understand how to program the bots, connect them to exchanges, and set appropriate parameters (14).

Vulnerability to Technical Issues and Security Risks: Bots can be susceptible to technical issues, such as software bugs or connectivity problems, leading to unintended trades and financial losses. Additionally, they are vulnerable to security risks, such as hacking (15).

Less Adaptability to Unexpected Market News: While bots can execute predefined strategies efficiently, they may need help adapting to sudden, unexpected market events or news that significantly impacts market conditions (16).

By understanding the basics of automated trading and weighing its advantages and disadvantages, traders can better assess whether this approach aligns with their trading goals and technical capabilities.

Comparison: Manual Trading vs. Automated Trading

Understanding the differences between manual and automated trading is crucial for any trader. The following table provides a clear comparison of the key features of both trading methods, helping you to evaluate which approach aligns best with your trading style and goals. By examining aspects such as decision-making processes, emotional influence, time commitment, and more, you can make a more informed decision about the most suitable trading strategy for your needs.

| Feature | Manual Trading | Automated Trading |

|---|---|---|

Decision-Making |

Based on trader's analysis and intuition |

Based on predefined algorithms and strategies |

Emotional Influence |

High; prone to fear and greed |

None; emotionless trading |

Time Commitment |

High; requires constant monitoring |

Low; operates 24/7 without human intervention |

Flexibility |

High; can adapt to real-time news and events |

Low to medium; limited to programmed responses |

Speed and Efficiency |

Moderate; dependent on trader's reaction time |

High; executes trades in milliseconds |

Technical Knowledge Required |

Low to medium; understanding of trading principles |

High; requires programming and setup knowledge |

Risk of Human Error |

High; susceptible to mistakes |

Low; follows precise algorithms |

Adaptability to Market Changes |

High; can quickly change strategies |

Low; needs reprogramming to adapt |

Cost |

Variable; no specific cost but time-intensive |

High; costs for development, purchase, and maintenance |

Market Conditions |

Effective in various conditions with skilled trader |

Depends on bot strategy; some excel in specific conditions |

User Experiences and Testimonials

Manual Trading Experiences

Manual trading has its share of enthusiasts who value the direct control and flexibility it offers. Traders often share their experiences on forums, detailing both the highs and lows of this approach.

Success Stories

Many manual traders report significant successes, particularly when leveraging their market knowledge and reacting swiftly to news and market shifts. For example, during the 2017 crypto boom, numerous traders profited handsomely by manually buying and holding Bitcoin through strategic dips (1, 2).

Challenges

Manual trading has challenges, including the emotional strain and time commitment required to stay on top of market trends. Emotional decisions, such as panic selling during a downturn, can lead to substantial losses. Additionally, constant monitoring of the markets can lead to burnout and missed opportunities (3, 4).

Automated Trading Experiences

Automated trading has grown in popularity, with many traders appreciating bots' efficiency and emotion-free decision-making.

Positive Feedback

Users of trading bots like Cryptohopper and 3Commas often highlight the ease of use and the ability to trade 24/7 without constant monitoring. These bots can execute complex strategies and manage trades at speeds that manual traders cannot match, leading to consistent profits in various market conditions (5, 6).

Concerns

Despite the advantages, some users express concerns about the initial setup complexity and the need for ongoing technical maintenance. Security risks, such as hacking and software bugs, are everyday worries among users. There are instances where bots have malfunctioned during unexpected market crashes, leading to significant losses (7, 8).

Community Insights

Numerous online communities provide a platform for traders to share their experiences and insights. Reddit's r/CryptoCurrency, Bitcointalk, and dedicated Discord groups for specific bots like Gunbot and HaasOnline are popular places where traders discuss strategies, troubleshoot issues, and share success stories.

Many users provide detailed testimonials on platforms like Trustpilot and bot-specific forums. These testimonials often highlight the practical aspects of using bots, from setup to execution, and the real-world performance of different strategies.

By examining user experiences and testimonials, traders can gain valuable insights into the practical aspects of manual and automated trading. This understanding can help them decide which trading method best suits their needs and capabilities.

Exploring SYGNAL's Automated Trading Strategies

Introduction to SYGNAL

SYGNAL stands out as a premier provider of automated trading strategies meticulously crafted by professional quants. These strategies are designed to maximise profits, manage risk, and reduce drawdowns across various market cycles. SYGNAL offers a range of solutions that combine the best aspects of automated and manual trading for traders looking to enhance their trading performance while mitigating risks.

Advantages of SYGNAL's Strategies

Professional Quant Strategies: SYGNAL's trading strategies are developed by professional quantitative analysts. These strategies leverage advanced statistical models and AI-driven insights to make informed trading decisions. This professional touch ensures traders use top-tier methodologies typically only available to institutional investors.

Risk Management: A key advantage of SYGNAL's strategies is their robust risk management framework. These strategies are designed to perform well during bull markets and protect capital during bear markets and high volatility periods. By managing risk and reducing drawdowns, SYGNAL helps traders maintain more consistent performance.

Plug and Play: SYGNAL's automated trading strategies are user-friendly and easy to implement. Traders can find these strategies on their favourite bot platforms, allowing quick and seamless integration. This plug-and-play functionality makes it accessible for beginner and experienced traders to benefit from sophisticated trading systems without requiring extensive setup.

Multi-Market Cycle Efficiency: Unlike many strategies that only perform well in specific market conditions, SYGNAL's strategies are designed to be effective across multiple market cycles. This includes bull markets, bear markets, and periods of high volatility. By being adaptable to different market environments, these strategies provide traders with a reliable toolset for all trading scenarios.

Highlighted Strategies

Adaptive Momentum: This strategy leverages momentum indicators to adapt to changing market conditions, ensuring that trades are aligned with the prevailing market trends. By continuously adjusting its parameters, Adaptive Momentum maximises gains while minimising risks during upward and downward market movements.

AltcoinWave AI: Utilising AI to analyse wave patterns in altcoin markets, AltcoinWave AI identifies optimal trade entry and exit points. This strategy is particularly effective in capturing altcoins' unique volatility and growth potential, making it a valuable tool for traders looking to diversify their portfolios.

Cadence: Cadence employs systematic trading based on advanced statistical models. This strategy maintains a balanced and disciplined trading approach, aiming for steady growth through calculated trades. Cadence is designed to reduce the emotional impact on trading decisions by adhering strictly to its algorithmic framework.

Equilibria: Balancing multiple trading strategies, Equilibria aims to create a stable trading environment by diversifying risk. This strategy integrates various approaches to ensure that it can handle different market conditions, providing a smoother equity curve and reducing the impact of market volatility.

Fusion AI: Fusion AI combines several AI-driven strategies to enhance trading performance. This strategy seeks to optimise returns and manage risks by integrating multiple algorithms. Fusion AI's comprehensive approach allows it to adapt to various market scenarios, providing a versatile trading solution.

Perennial Surge: Focusing on long-term growth and consistency, Perennial Surge aims to deliver steady returns by adhering to a long-term investment horizon. This strategy uses trend-following and risk-management techniques to ensure it can weather market fluctuations and deliver sustainable growth.

Why Choose SYGNAL?

Market-Leading Innovation: SYGNAL is one of the few providers offering portfolio-oriented, multi-market cycle strategies that are meticulously risk-managed. This makes SYGNAL a unique and valuable choice for traders looking to optimise their trading performance across various market conditions.

Ease of Use: With strategies available on popular trading platforms, integrating SYGNAL's solutions into your trading routine is straightforward and hassle-free. This accessibility ensures that traders of all levels can benefit from advanced automated trading.

Continuous Improvement: SYGNAL continuously monitors and improves its strategies, regularly adding new features and integrating with additional bot platforms to provide users with the best trading tools.

By exploring SYGNAL's automated trading strategies, traders can enhance their trading performance, manage risks more effectively, and achieve consistent results across different market cycles. Visit SYGNAL.ai to learn more and get started with these innovative trading solutions.

Conclusion

In the rapidly evolving world of cryptocurrency trading, manual and automated trading strategies offer unique advantages and challenges. Manual trading gives traders flexibility, control, and the ability to leverage human intuition and market sentiment to make nuanced decisions. However, it also demands significant time and emotional discipline and is prone to human error and emotional decision-making.

Automated trading, on the other hand, excels in efficiency, speed, and the elimination of emotional biases. Trading bots can operate 24/7, executing complex strategies and managing trades at a pace that human traders cannot match. While these bots require initial technical setup and ongoing maintenance, they offer a robust solution for consistent trading performance across various market conditions.

User experiences and testimonials from various trading communities highlight both approaches' practical benefits and challenges. Manual traders often share success stories of significant gains through strategic trading during market booms. In contrast, automated trading enthusiasts appreciate the continuous, emotion-free trading bots offer. Nevertheless, both methods have their pitfalls, such as the emotional strain in manual trading and the technical vulnerabilities in automated trading.

SYGNAL bridges the gap between these two approaches by offering professional quant-driven trading strategies that combine the best of both worlds. SYGNAL's strategies are designed not only for profitability but also for managing risk and reducing drawdowns across all market cycles. These plug-and-play strategies are available on popular trading platforms, making them accessible to novice and experienced traders. With a focus on multi-market cycle efficiency and robust risk management, SYGNAL provides traders with reliable tools to enhance their trading performance.

By exploring the diverse options of manual and automated trading and considering the advanced solutions provided by SYGNAL, traders can make informed decisions that align with their trading goals and capabilities. Visit SYGNAL.ai to learn more and leverage these innovative trading strategies for improved trading outcomes.